Life insurance and the decision to enroll in a policy are decisions many people consider to protect their loved ones. The industry can be confusing to many. Here are some life insurance statistics that cover most of the facts that people might not know.

General Life Insurance Statistics

- In 2019, the most significant payout for surrender benefits and withdrawals from life insurance contracts issued to policyholders who cancelled or withdrew cash from their policies was $309 billion. (iii.org, 2019)

- The proportion of consumers who choose internet sales for life insurance has risen from 17% in 2011 to 29% by 2020. (iii.org, 2019)

- 52% of people living in U.S. have life insurance. (Statista.com, 2021)

- About 30 million people with life insurance in the U.S. are underinsured. (Simplyinsurance.com, 2021)

- 52% of Americans have life insurance. (Insurance-forums.com, 2021)

- In the United States in 2019, there were 837 different firms selling life insurance. (iii.org, 2020)

- More than half of Americans believe that life insurance is more expensive than it actually is. (LifeHealth, 2021)

- Since 2011, the American life insurance sector has been in decline. (Lifehealth.com, 2021)

- 41% of Americans prefer to buy for insurance in person. (Deloitte.com, 2021)

- By 2026, the worldwide health insurance industry is expected to be worth $1.2 trillion. (PR Newswire, 2021)

- Firms issued individual life insurance contracts of $12,388,298 million in 2019. (ACLI, 2020)

- Between 2018 and 2019, group life policies in the United States fell by 0.1%. (ACLI, 2020)

- The total amount of credit life insurance issued in 2019 was $87.346 million. (ACLI, 2020)

- Taiwan has the highest insurance-to-GDP ratio in the world. (Statista, 2020)

- In 2019, the average face amount of a life insurance policy in the United States was $178,150. (SpendMeNot, 2020)

- Insurers in the United States must maintain cash reserves between 8% and12% of their total assets. (Investopedia, 2021)

- The 9/11 attacks cost insurers $40 billion, although several had sufficient cash reserves to cover premiums. (Investopedia.com, 2021)

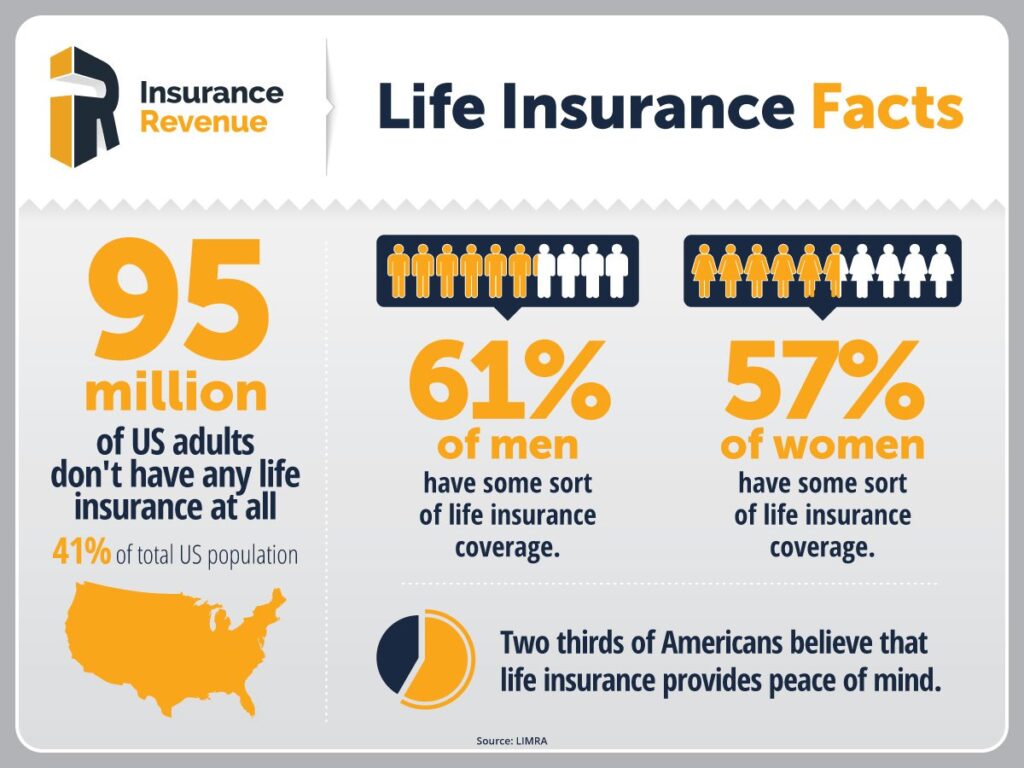

- In America, the portion of insured persons has fallen from 63% to 52% in 2021. (LIMRA, 2021)

- Being a smoker means paying two to three times the standard cost for life insurance. (Policy Genius, 2021)

- Since 2016, there has been an overall steady decline in the number of insured Americans. (LIMRA, 2021)

- The Presbyterian Ministers Fund, founded in 1759, was the United States’ first life insurer. (Investopedia, 2021)

- Parents who have children under 18 are more likely to have life insurance than Americans who do not have young children (66% versus 50%). (Nerdwallet.com, 2020)

- Approximately 2 in 5 Americans (39%) don’t have life insurance coverage, either via their employer or an insurance provider. Another 7% are unsure if they have coverage. (Nerdwallet.com, 2020)

- One-quarter of all Americans who have life insurance (25%) have acquired or increased their coverage due to the COVID-19 outbreak. (Nerdwallet.com, 2020)

- Due to the COVID-19 epidemic, about one in every seven Americans who did not get life insurance via a company/broker (14%) considered acquiring life insurance but eventually opted not to. More than a third (35%) said they opted against it since COVID-19 incidences in their region began to decline. (Nerdwallet.com, 2020)

Gender & Life Insurance Statistics

- The average premiums for males between the ages of 25 and 50 increases by 258%. (Bankrate.com, 2021)

- Women often pay 23% less for life insurance than men because they are less prone to participate in dangerous activities that might result in their death. In addition, women tend to live longer than men, which results in cheaper premiums. (Investopedia.com, 2021)

Age & Life Insurance Statistics

- The average life expectancy in the United States in 2020 was 77.8, down a full year from 2019. (Npr.org, 2021)

- 28% of millennials and 29% of older boomers are happy to do their policy purchase and analysis online. (Agentforthefuture.com, 2019)

- 28% of millennials, 32% of Gen Xers, and 29% of baby boomers prefer to study and purchase insurance products online. (Agentforthefuture.com, 2019)

- Between 1950 and 2020, the portion of Americans over the age of 65 more than doubled. (Statista, 2021)

- Millennials (years 24-39) who have life insurance are more likely than their older counterparts to have obtained or expanded coverage as a result of the pandemic – 42%, compared to 30% of Gen Xers (ages 40-55) and 5% of baby boomers (ages 56-74). (Nerdwallet.com, 2020)

Technology & Life Insurance Statistics

- Since 2013, investments in the Insurtech business have expanded each year. (Statista, 2020)

- Claims automation might save insurers up to 30% on costs. (McKinsey & Company, 2021)

- 80% of customers are eager to execute transactions and complete tasks using digital media. (EY, 2019)

- The insurance business spending on AI technology and software is expected to reach $571 million by the end of 2021. (Statista, 2021)

Life Insurance Companies Statistics

- Since 2001, the total number of life insurers in the United States has steadily declined. (ACLI, 2019)

- According to insurance industry trends for 2020, two of the top 10 insurers in terms of market capitalization were American. (Statista, 2021)

- Metlife is the world’s fifth-largest insurer, with a market capitalization of $32.8 billion. (Statista, 2021)

- Aflac is ranked seventh, with a market value of $26.9 billion. (Fortune.com, 2021)

- With a market valuation of $187.2 billion, China’s Ping an Insurance Group is the world’s largest insurer. (Statista, 2021)

- In 2020, the United States had the highest value of written premiums. (Swiss Re, 2020)

- The premiums written in the United States in 2019 were valued at $632.687 billion. (SpendMeNot, 2020)

Life Insurance in the U.S. & Worldwide Statistics

- China finished in second place with premiums of $347.545 billion. (Spendmenot.com, 2021)

- Japan came in third place, with a premium value of $294.497 billion. (Spendmenot.com, 2021)

- Prudential Financial is the largest insurer in the US with $915.387 billion in assets. Berkshire Hathaway comes in a close second with $788.113 billion in assets, followed by New York Life with $324.78 billion. (Spendmenot.com, 2021)

- In 2022, there will be 1,073,806 insurance brokers, agents, and employees in the United States. (IBISWorld, 2022)

- Berkshire Hathaway is the world’s largest insurance firm by revenue. (Insurance Information Institute, 2020)

- Californians received the most coverage in 2018 with $356.98 billion. (Policy Genius, 2021)

- Wyoming had the least amount of coverage in 2018 with only $4.59 billion. (Policy Genius, 2021)

Conclusion

Insurance is beneficial and is encouraged for every individual because of the numerous benefits it can provide. These life insurance statistics show how putting off purchasing life insurance may prove to be a costly decision.

Discussion about this post